Are business inventory sheets legal documents 4 – Are business inventory sheets legal documents? The answer is yes, in many cases. Inventory sheets are considered legal documents when they are used to record the quantity, description, and value of inventory on hand. This information can be used to support claims for insurance purposes, tax audits, and other legal proceedings.

Different types of inventory sheets have different legal implications. Periodic inventory sheets are typically used to track inventory levels at specific points in time, while perpetual inventory sheets are used to track inventory levels on an ongoing basis. Both types of inventory sheets can be used as evidence in legal proceedings, but perpetual inventory sheets are generally considered to be more reliable because they provide a more up-to-date record of inventory levels.

Legal Status of Business Inventory Sheets

Business inventory sheets are legal documents that provide a record of the items a business has on hand. They are used for a variety of purposes, including:

- Tracking inventory levels

- Calculating the cost of goods sold

- Preparing financial statements

- Filing taxes

Inventory sheets are considered legal documents because they can be used to prove the value of a business’s assets. In the event of a dispute, inventory sheets can be used to show the value of the items that were on hand at a specific point in time.

Situations Where Inventory Sheets Are Considered Legal Documents

There are a number of situations where inventory sheets are considered legal documents. These include:

- When they are used to file taxes

- When they are used to support a claim for insurance

- When they are used to prove the value of a business’s assets in a lawsuit

Inventory sheets are an important part of any business’s financial records. They can be used for a variety of purposes, and they can be considered legal documents in certain situations.

Types of Inventory Sheets and Their Legal Implications: Are Business Inventory Sheets Legal Documents 4

Inventory sheets are crucial documents for businesses, serving as a record of their assets. Different types of inventory sheets carry varying legal implications, and understanding these nuances is essential for business owners.

Periodic Inventory Sheets

Periodic inventory sheets are prepared at specific intervals, typically at the end of an accounting period or financial year. They provide a snapshot of the inventory on hand at a particular point in time. Legally, periodic inventory sheets are considered less reliable than perpetual inventory sheets because they are not updated regularly.

Perpetual Inventory Sheets

Perpetual inventory sheets are continuously updated as transactions occur, providing a real-time record of inventory levels. This continuous update makes perpetual inventory sheets more accurate and reliable than periodic inventory sheets. Legally, perpetual inventory sheets are generally considered more credible and may be used as evidence in legal proceedings.

Legal Implications of Inventory Sheets

Inventory sheets can serve as evidence in legal proceedings related to:

- Tax audits: Inventory sheets are used to verify the accuracy of reported inventory levels for tax purposes.

- Insurance claims: Inventory sheets provide documentation of lost or damaged inventory during events like fires or thefts.

- Contract disputes: Inventory sheets can be used to prove the existence and quantity of goods sold or delivered under a contract.

It is important for businesses to maintain accurate and up-to-date inventory sheets to ensure their legal validity and credibility in legal proceedings.

Legal Requirements for Inventory Sheets

Maintaining accurate and complete inventory sheets is crucial for businesses, as they serve as legal documents that provide a record of the company’s assets. Failure to comply with legal requirements can result in penalties and legal complications.

Legal Requirements for Inventory Sheets

Businesses must adhere to specific legal requirements when maintaining inventory sheets. These requirements include:

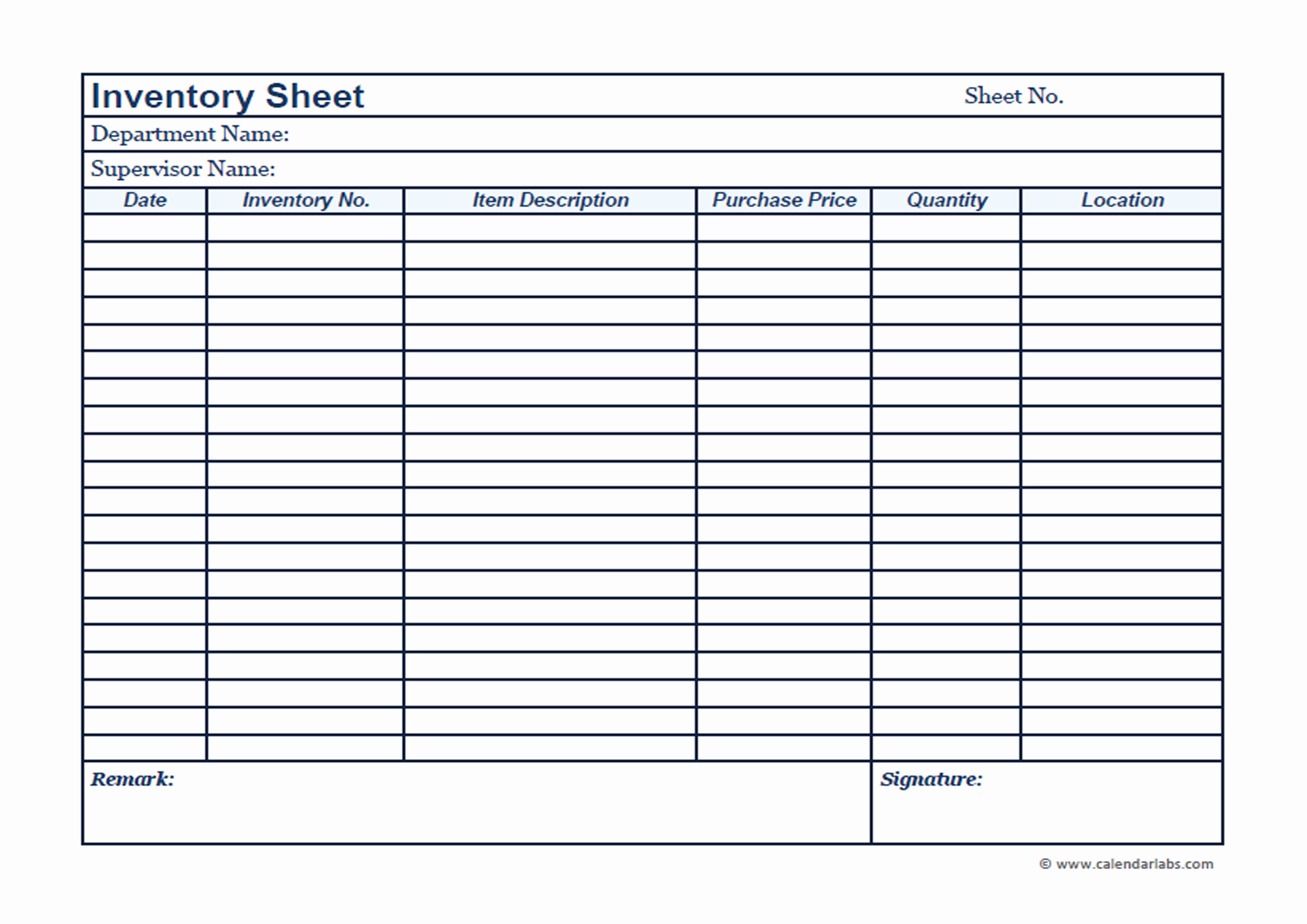

- Accurate recording of all inventory items, including their quantity, description, and value.

- Regular updates to ensure the inventory sheet reflects the current inventory status.

- Proper storage and security of inventory sheets to prevent unauthorized access or alteration.

- Compliance with industry-specific regulations and standards related to inventory management.

Consequences of Failing to Meet Legal Requirements

Failure to meet legal requirements for inventory sheets can lead to severe consequences, including:

- Financial penalties and fines imposed by regulatory authorities.

- Loss of credibility with stakeholders, such as investors, creditors, and customers.

- Difficulty in obtaining financing or insurance due to unreliable financial records.

- Legal liability in the event of disputes or audits.

Guidance on Ensuring Compliance

To ensure inventory sheets comply with legal standards, businesses should:

- Establish clear policies and procedures for inventory management.

- Train staff on proper inventory tracking and recording methods.

- Implement an inventory management system that automates updates and ensures accuracy.

- Conduct regular inventory audits to verify the accuracy of inventory sheets.

- Seek professional guidance from accountants or legal counsel to ensure compliance with specific industry regulations.

By adhering to these guidelines, businesses can maintain legally compliant inventory sheets that accurately reflect their assets and support their financial reporting and decision-making processes.

Use of Inventory Sheets in Business Transactions

Inventory sheets play a crucial role in business transactions, serving as essential documents that record and track the movement of inventory items. They are used in various scenarios, including sales, purchases, and audits, and carry significant legal implications.

Sales Transactions

During sales transactions, inventory sheets provide a detailed record of the items sold, their quantities, and prices. This information is crucial for accurately calculating the total sales revenue and updating the inventory levels. Inventory sheets also serve as proof of the transaction, protecting businesses from disputes over the quantity or type of items sold.

Purchase Transactions

In purchase transactions, inventory sheets are used to document the items purchased, their quantities, and costs. This information is essential for tracking inventory levels, managing supplier relationships, and calculating the cost of goods sold. Inventory sheets also provide evidence of the purchase, protecting businesses from disputes over the quantity or quality of items received.

Audits

Inventory sheets are essential during audits, both internal and external. Auditors rely on inventory sheets to verify the accuracy of the business’s inventory records and ensure compliance with accounting standards. Accurate inventory sheets help businesses avoid discrepancies and potential legal issues during audits.

Legal Protection

Inventory sheets can be valuable legal documents in the event of disputes or legal proceedings. They provide concrete evidence of the quantity and condition of inventory items at a specific point in time. This information can be critical in resolving disputes over inventory shortages, damages, or ownership.

Best Practices for Managing Inventory Sheets

Maintaining accurate and up-to-date inventory records is crucial for businesses to ensure compliance and efficient operations. Here are some best practices to help you manage inventory sheets effectively:

Regular Inventory Reconciliation

Regularly reconcile your inventory sheets with physical inventory counts to identify any discrepancies. This process helps ensure that your records are accurate and up-to-date, minimizing errors and losses.

Organized and Up-to-Date Records

Maintain organized and up-to-date inventory records by consistently updating information, such as item descriptions, quantities, and costs. Use a systematic approach to record transactions and keep all supporting documentation for future reference.

Use of Technology

Consider using inventory management software or tools to automate processes, streamline data entry, and minimize errors. These tools can help you track inventory levels, generate reports, and facilitate inventory reconciliation.

Training and Accountability

Provide training to staff responsible for managing inventory to ensure they understand the importance of accuracy and compliance. Establish clear roles and responsibilities for inventory management, and hold individuals accountable for maintaining accurate records.

Internal Controls

Implement internal controls to prevent errors and fraud. This may include measures such as segregation of duties, regular audits, and documentation of inventory transactions.

Regular Review and Improvement, Are business inventory sheets legal documents 4

Regularly review your inventory management processes and identify areas for improvement. Seek feedback from staff and stakeholders to enhance the accuracy and efficiency of your inventory records.

End of Discussion

Businesses are required to maintain accurate and complete inventory sheets for a variety of legal reasons. Failure to do so can result in penalties, fines, or even criminal charges. By understanding the legal requirements for inventory sheets and following best practices for managing them, businesses can protect themselves from legal liability and ensure that their inventory records are accurate and reliable.

FAQ Section

What are the legal requirements for inventory sheets?

Inventory sheets must be accurate, complete, and up-to-date. They must also be signed by an authorized representative of the business.

What are the consequences of failing to meet the legal requirements for inventory sheets?

Failure to meet the legal requirements for inventory sheets can result in penalties, fines, or even criminal charges.

What are some best practices for managing inventory sheets?

Some best practices for managing inventory sheets include using a perpetual inventory system, reconciling inventory sheets regularly, and storing inventory sheets in a secure location.