Are businesses inventory taxed? The answer to this question is a resounding yes, and understanding the intricacies of inventory taxation is crucial for businesses of all sizes. This comprehensive guide delves into the complexities of inventory taxation, exploring the types of inventory subject to taxation, valuation methods, exemptions, reporting requirements, and audit procedures.

Navigating the complexities of inventory taxation can be a daunting task, but with the right knowledge and guidance, businesses can ensure compliance and optimize their tax strategies. This guide provides a clear and concise overview of the topic, empowering businesses to make informed decisions and effectively manage their inventory tax obligations.

Inventory Taxation Basics

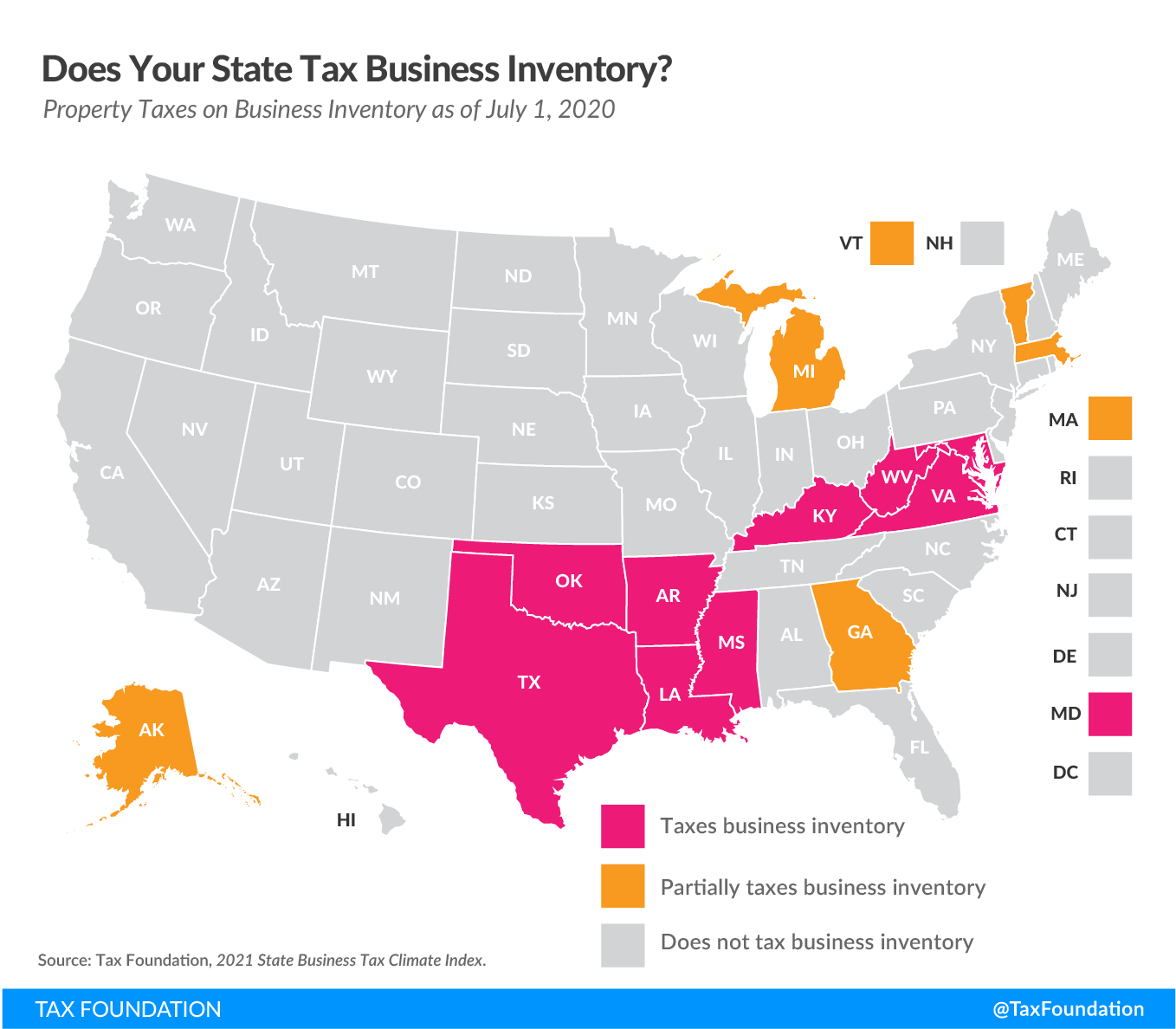

Inventory taxation involves the assessment of taxes on the value of goods held by businesses for sale or use in the production of other goods or services. The purpose of inventory taxation is to generate revenue for governments and ensure that businesses contribute their fair share to the tax burden.

The types of inventory subject to taxation vary depending on the jurisdiction. Generally, inventory includes raw materials, work-in-progress goods, and finished goods held for sale or use in the production process. Businesses that are required to pay inventory taxes include manufacturers, wholesalers, retailers, and other entities that maintain inventory as part of their operations.

Taxation of Different Inventory Types

The taxation of different inventory types can vary based on their classification and the specific tax laws applicable in each jurisdiction.

- Raw Materials:Raw materials are typically taxed at a lower rate compared to finished goods, as they have not yet undergone significant processing or value addition.

- Work-in-Progress Goods:Work-in-progress goods are partially completed products that are still undergoing processing. They are often taxed at a rate between that of raw materials and finished goods, reflecting their intermediate stage of completion.

- Finished Goods:Finished goods are complete products ready for sale to customers. They are typically taxed at the highest rate among inventory types, as they represent the final stage of production and have the highest value.

Methods of Inventory Valuation

Inventory valuation methods determine the value of a business’s inventory for tax purposes. Choosing the appropriate method is crucial as it can significantly impact the tax liability of the business.

Specific Identification Method

- This method assigns a specific cost to each unit of inventory.

- Advantages: Accurate tracking of costs for specific items, especially for high-value or unique inventory.

- Disadvantages: Time-consuming and challenging to implement, particularly for large inventories.

First-In, First-Out (FIFO) Method

- Assumes that the oldest inventory is sold first.

- Advantages: Simplicity and ease of implementation.

- Disadvantages: May not accurately reflect the current value of inventory, especially during periods of inflation.

Last-In, First-Out (LIFO) Method

- Assumes that the most recently purchased inventory is sold first.

- Advantages: Can result in lower taxable income during periods of inflation.

- Disadvantages: May not accurately reflect the physical flow of inventory, and can lead to higher taxable income during periods of deflation.

Weighted Average Cost Method

- Calculates the average cost of inventory based on all purchases made during a specific period.

- Advantages: Simplicity and ease of calculation.

- Disadvantages: May not accurately reflect the current value of inventory, especially during periods of significant price fluctuations.

Lower of Cost or Market (LCM) Method

- Values inventory at the lower of its cost or current market value.

- Advantages: Ensures that the inventory is not overvalued.

- Disadvantages: Can result in significant fluctuations in inventory value, especially during periods of market volatility.

Inventory Tax Exemptions: Are Businesses Inventory Taxed

Inventory tax exemptions provide relief from taxation on certain types of inventory held by businesses. These exemptions can significantly reduce the tax burden for businesses, particularly those with large inventories. To qualify for an exemption, businesses must meet specific requirements and provide supporting documentation.

Types of Inventory Exempt from Taxation

Various types of inventory may be exempt from taxation, including:

Raw materials and work-in-progress

These are items that are not yet ready for sale and are used in the production of finished goods.

Finished goods held for resale

These are items that are ready for sale and are held in inventory until they are sold to customers.

Supplies

These are items used in the day-to-day operations of a business, such as office supplies, cleaning supplies, and tools.

Requirements for Inventory Tax Exemptions

To qualify for an inventory tax exemption, businesses must meet the following requirements:

- The inventory must be held for use in the business’s operations and not for personal use.

- The inventory must be located in the state where the business is registered.

- The business must maintain accurate records of its inventory, including the cost of the inventory, the date of purchase, and the date of sale.

Examples of Businesses that have Claimed Inventory Tax Exemptions

Numerous businesses have successfully claimed inventory tax exemptions, including:

Manufacturers

Manufacturers can claim exemptions for raw materials and work-in-progress.

Retailers

Retailers can claim exemptions for finished goods held for resale.

Contractors

Contractors can claim exemptions for supplies used in their work.By understanding the types of inventory that are exempt from taxation and the requirements that must be met to qualify for an exemption, businesses can reduce their tax burden and improve their financial performance.

Inventory Tax Reporting

Businesses subject to inventory taxes must comply with specific reporting requirements to ensure accurate and timely tax payments. These requirements vary depending on the jurisdiction and tax regulations.

Forms and Schedules, Are businesses inventory taxed

Typically, businesses are required to file tax returns and schedules that provide details of their inventory. Common forms and schedules include:

Tax Return

The main tax return, such as Form 1040 in the United States, typically includes a section or schedule dedicated to inventory reporting.

Inventory Schedule

A separate schedule that provides detailed information about the business’s inventory, including the cost, quantity, and other relevant details.

Cost of Goods Sold (COGS) Schedule

A schedule that summarizes the cost of goods sold during the tax year, which is calculated based on the inventory valuation method used.

Common Errors

Businesses often make errors when reporting inventory taxes, which can lead to penalties or additional tax assessments. Some common errors include:

Incorrect Inventory Valuation

Using an incorrect inventory valuation method or failing to consistently apply the chosen method.

Overstating Inventory Value

Including obsolete or damaged inventory in the valuation.

Understating Inventory Value

Failing to account for all inventory on hand or using an incorrect cost basis.

Failing to File Required Forms

Neglecting to file the necessary tax forms and schedules, including the inventory schedule.

Late Filing

Submitting tax returns and schedules after the prescribed deadline.

Inventory Tax Audits

Inventory tax audits are conducted by tax authorities to verify a business’s compliance with inventory tax laws. These audits involve examining a business’s inventory records, accounting practices, and supporting documentation to ensure that the business is accurately reporting its inventory for tax purposes.

Procedures Used in Inventory Tax Audits

Tax authorities use various procedures to audit businesses for inventory tax compliance, including:

Physical inventory verification

The auditor will compare the physical inventory on hand with the inventory records to identify any discrepancies.

Review of inventory records

The auditor will examine the business’s inventory records, including purchase orders, invoices, and stock records, to verify the accuracy of the inventory data.

Analysis of accounting practices

The auditor will review the business’s accounting practices to ensure that they are consistent with the applicable tax laws and regulations.

Examination of supporting documentation

The auditor will examine supporting documentation, such as receipts, invoices, and purchase orders, to verify the accuracy of the inventory records.

Steps Businesses Can Take to Prepare for an Inventory Tax Audit

Businesses can take several steps to prepare for an inventory tax audit, including:

Maintaining accurate inventory records

Businesses should ensure that their inventory records are accurate and up-to-date.

Establishing a system for tracking inventory

Businesses should implement a system for tracking inventory, including the receipt, storage, and disposal of inventory items.

Reconciling inventory records regularly

Businesses should reconcile their inventory records with the physical inventory on hand on a regular basis.

Documenting inventory-related transactions

Businesses should document all inventory-related transactions, including purchases, sales, and adjustments.

Common Issues Raised During Inventory Tax Audits

Common issues that are raised during inventory tax audits include:

Inaccurate inventory records

Errors in inventory records can lead to an incorrect calculation of taxable income.

Incorrect inventory valuation methods

Using an incorrect inventory valuation method can result in an overstatement or understatement of taxable income.

Unrecorded inventory

Businesses may fail to record all inventory items, which can lead to an understatement of taxable income.

Overstated inventory

Businesses may overstate the value of their inventory, which can lead to an overstatement of taxable income.

Last Point

In summary, inventory taxation is a multifaceted aspect of business operations that requires careful attention to ensure compliance and optimize tax efficiency. By understanding the various components of inventory taxation, businesses can navigate the complexities of this area and make informed decisions that support their long-term financial success.

Essential Questionnaire

What types of inventory are subject to taxation?

Inventory that is held for sale in the ordinary course of business is generally subject to taxation.

How are different valuation methods used to value inventory for tax purposes?

Common inventory valuation methods include FIFO (first-in, first-out), LIFO (last-in, first-out), and weighted average cost.

What are the requirements that must be met to qualify for an inventory tax exemption?

Inventory that is held for resale or used in the production of goods or services may be eligible for tax exemptions.

What are common errors that businesses make when reporting inventory taxes?

Common errors include incorrect inventory valuation, failure to report all inventory, and incorrect calculation of tax liability.