The business inventory book, a cornerstone of inventory management, takes center stage in this captivating guide. Dive into the intricacies of inventory tracking, unraveling its significance, components, and methodologies with engaging prose that illuminates the topic with unparalleled clarity.

From understanding the fundamental concept to mastering the art of inventory control, this comprehensive resource empowers businesses to optimize their inventory management strategies, ensuring seamless operations and profitability.

Business Inventory Book

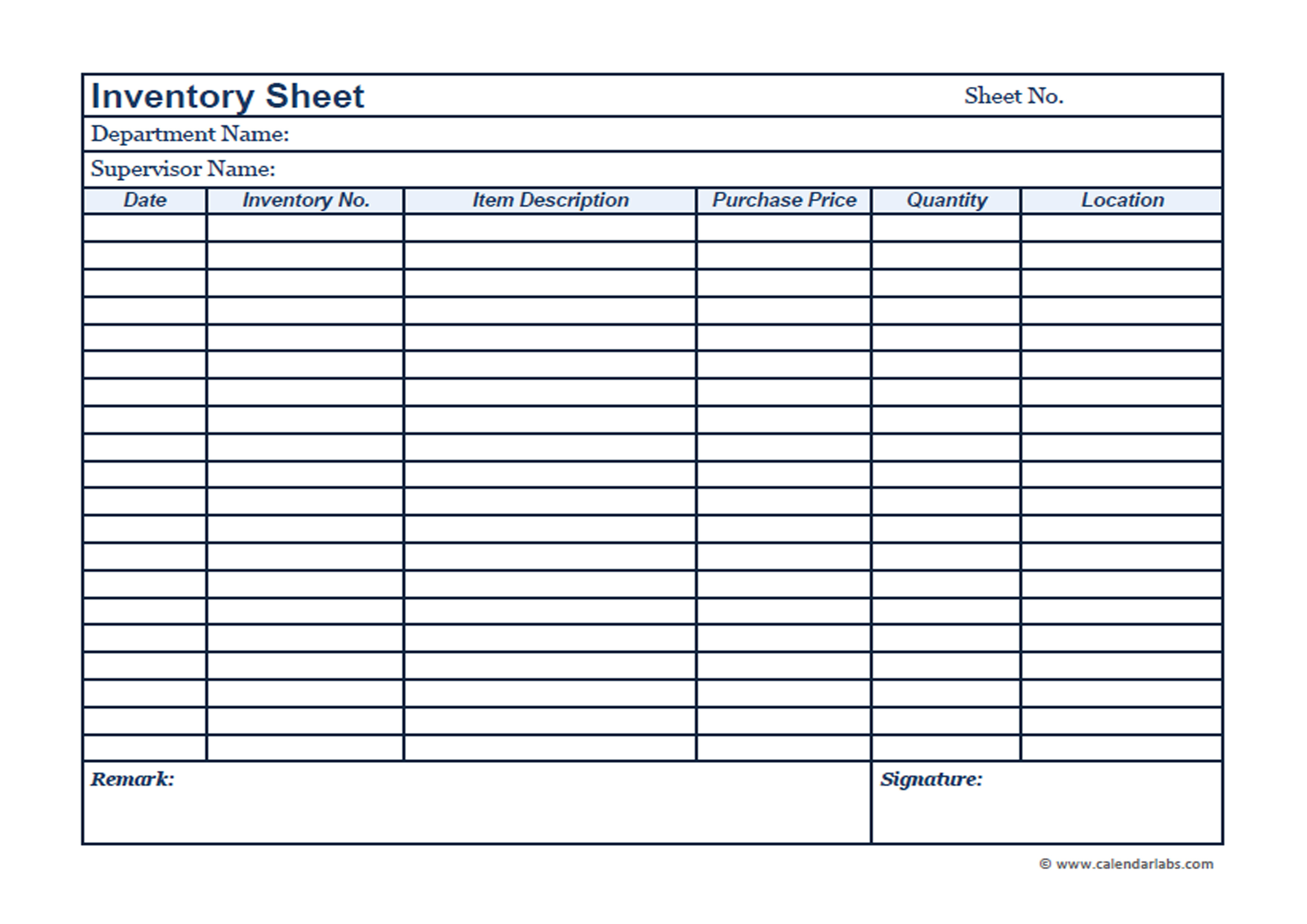

A business inventory book is a document that records the details of a company’s inventory, including the quantity, description, and value of each item. It is an essential tool for inventory management, as it allows businesses to track their stock levels, identify trends, and make informed decisions about ordering and production.

Importance of Business Inventory Book

- Accurate Stock Records:An inventory book provides a detailed record of all inventory items, ensuring accurate and up-to-date information on stock levels.

- Efficient Inventory Management:It facilitates efficient inventory management by providing a central repository for inventory data, enabling businesses to track stock levels, identify discrepancies, and optimize ordering processes.

- Improved Decision-Making:By analyzing inventory data, businesses can make informed decisions about inventory levels, production schedules, and purchasing strategies.

- Reduced Costs:An inventory book helps businesses avoid overstocking and understocking, which can lead to reduced storage costs, lower carrying costs, and increased profitability.

- Compliance with Regulations:Many industries require businesses to maintain accurate inventory records for compliance with regulations, such as tax reporting and financial audits.

Businesses that Use Inventory Books

- Retail Stores

- Manufacturers

- Wholesalers

- Distributors

- Warehouses

Components of a Business Inventory Book

An inventory book is a crucial tool for businesses to manage and track their inventory effectively. It serves as a detailed record of all the items held by the business, providing valuable information for various aspects of operations, such as stock management, cost control, and decision-making.

A comprehensive inventory book consists of several essential sections, each playing a specific role in maintaining accurate and up-to-date inventory records.

Item Description

- Provides a detailed description of each item in the inventory, including its name, model number, size, and any other relevant attributes.

- Helps in identifying and differentiating items, especially when dealing with similar or interchangeable products.

Quantity

- Records the number of units of each item currently in stock.

- Provides a clear understanding of the availability of items, enabling businesses to make informed decisions about reordering and stock replenishment.

Unit Price

- Specifies the cost of a single unit of each item.

- Essential for calculating the total value of inventory and tracking cost fluctuations.

Importance of Accurate Records

Maintaining accurate inventory records is paramount for businesses. It allows them to:

- Avoid stockouts and ensure customer satisfaction.

- Minimize losses due to overstocking or obsolete inventory.

- Optimize inventory levels to reduce carrying costs.

- Improve forecasting and planning for future demand.

- Comply with accounting and tax regulations.

Types of Business Inventory Books

Inventory books are essential tools for businesses to track and manage their inventory. There are two main types of inventory books: perpetual and periodic.

Perpetual Inventory Books

Perpetual inventory books keep a running balance of inventory on hand. This is done by updating the inventory records every time an item is purchased or sold. Perpetual inventory books are more accurate than periodic inventory books because they reflect the current inventory on hand at all times.

However, perpetual inventory books can be more time-consuming to maintain than periodic inventory books. This is because every transaction must be recorded in the inventory book.

Periodic Inventory Books

Periodic inventory books only update the inventory records at the end of a period, such as a month or a quarter. This makes periodic inventory books less accurate than perpetual inventory books, but they are also less time-consuming to maintain.

The type of inventory book that is best for a business depends on a number of factors, such as the size of the business, the type of inventory, and the frequency of transactions.

Methods for Maintaining a Business Inventory Book

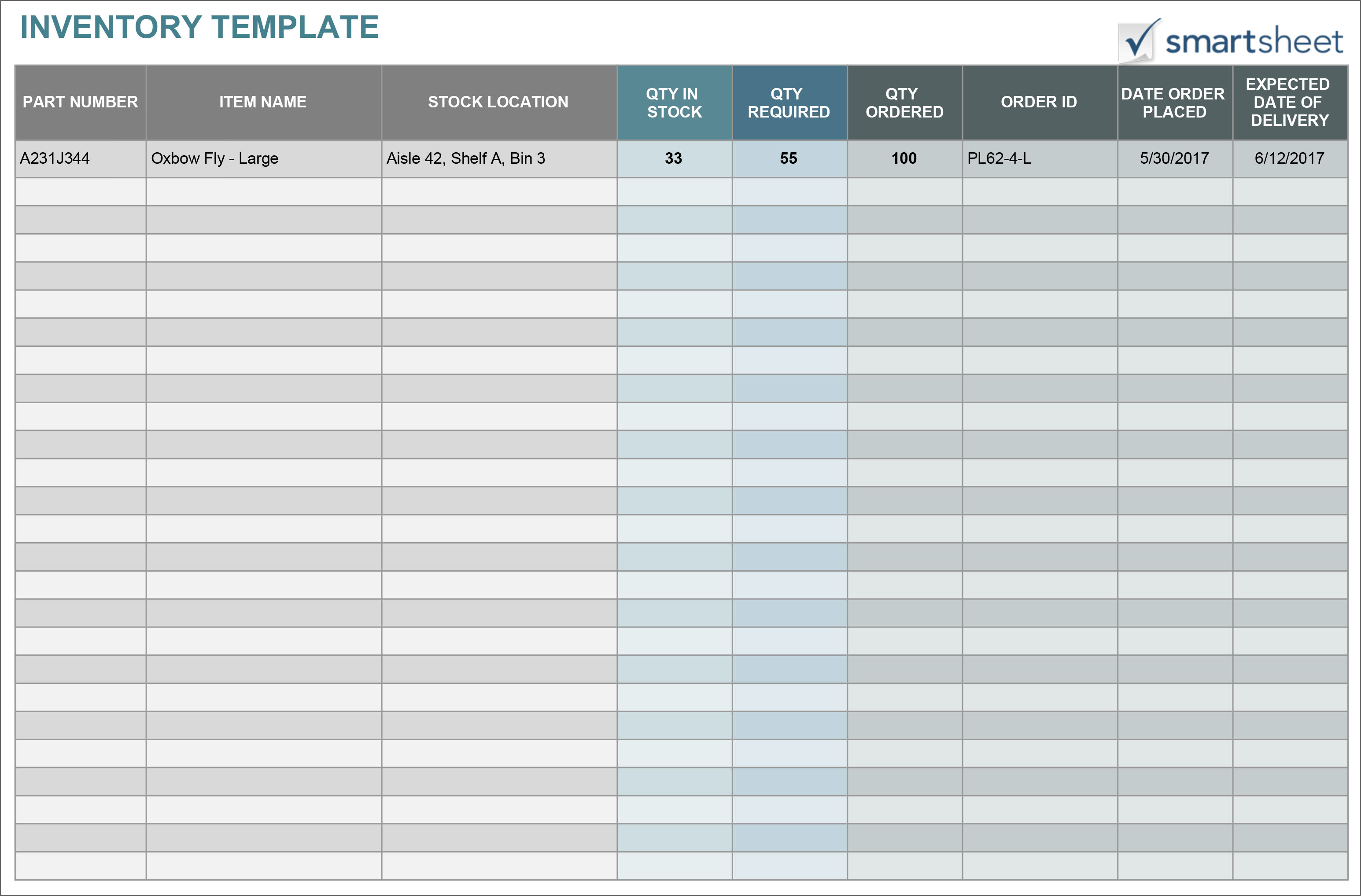

Maintaining an inventory book is crucial for businesses to keep track of their stock and manage their inventory efficiently. Several methods can be employed for this purpose, ranging from manual to automated systems.

Manual Inventory Tracking

- Physical Inventory:Involves manually counting and recording the stock on hand at regular intervals.

- Bin Cards:Individual cards are maintained for each item, with details like quantity, location, and movement recorded.

- Periodic Inventory:The inventory is counted and recorded at specific intervals, such as monthly or quarterly.

Automated Inventory Tracking

- Inventory Management Software:Specialized software that tracks inventory levels, generates reports, and automates inventory-related processes.

- Barcode Scanners:Devices used to scan barcodes on products, allowing for quick and accurate inventory updates.

- Radio Frequency Identification (RFID):Uses RFID tags to track inventory items, providing real-time visibility into stock levels.

Tips for Efficient Inventory Management

- Regular Inventory Audits:Conduct regular audits to verify inventory accuracy and identify discrepancies.

- Use Inventory Forecasting:Forecast future demand based on historical data to optimize inventory levels.

- Implement a Just-in-Time (JIT) Inventory System:Reduce inventory holding costs by receiving stock only when needed.

- Establish Safety Stock Levels:Maintain a buffer of inventory to mitigate unexpected demand fluctuations.

- Use Inventory Management KPIs:Track key performance indicators (KPIs) such as inventory turnover ratio and days of inventory on hand to monitor inventory performance.

Using a Business Inventory Book for Inventory Control

A business inventory book is a crucial tool for managing inventory levels effectively. It provides a systematic record of all inventory items, allowing businesses to track their stock levels, determine optimal inventory levels, and prevent stockouts and overstocking.

Determining Optimal Inventory Levels

Determining optimal inventory levels is essential to avoid both stockouts and overstocking. Optimal inventory levels ensure that a business has enough stock to meet customer demand without tying up excessive capital in inventory.

- ABC Analysis:This technique categorizes inventory items based on their annual usage value. Items with high usage value (A items) require more frequent monitoring and tighter inventory control.

- Economic Order Quantity (EOQ):This formula calculates the optimal quantity to order at a time to minimize total inventory costs, including ordering costs and holding costs.

- Safety Stock:This is an additional buffer of inventory maintained to protect against unexpected demand fluctuations or supply chain disruptions.

Preventing Stockouts and Overstocking

A business inventory book helps prevent stockouts by providing real-time information on inventory levels. By monitoring inventory levels regularly, businesses can identify items that are running low and place orders in advance to avoid stockouts.

The inventory book also helps prevent overstocking by providing a clear picture of inventory levels. By tracking inventory levels over time, businesses can identify items that are not selling well and adjust their inventory levels accordingly to avoid excessive holding costs.

Inventory Book and Inventory Valuation

Inventory valuation is crucial for financial reporting as it determines the value of inventory on hand at a specific point in time. This value is then used to calculate the cost of goods sold (COGS) and the ending inventory value, which are key components of the income statement and balance sheet, respectively.

There are several different inventory valuation methods that can be used, each with its own advantages and disadvantages. The most common methods include:

First-In, First-Out (FIFO)

- Under FIFO, the cost of the oldest inventory items is assigned to COGS first.

- This method assumes that the oldest inventory items are the first to be sold.

- FIFO tends to result in higher COGS and lower ending inventory values during periods of rising prices.

Last-In, First-Out (LIFO)

- Under LIFO, the cost of the most recently purchased inventory items is assigned to COGS first.

- This method assumes that the most recently purchased inventory items are the first to be sold.

- LIFO tends to result in lower COGS and higher ending inventory values during periods of rising prices.

The choice of inventory valuation method can have a significant impact on financial statements. For example, during periods of rising prices, FIFO will result in higher COGS and lower net income than LIFO. Conversely, during periods of falling prices, LIFO will result in higher COGS and lower net income than FIFO.

It is important to note that the inventory valuation method used must be consistently applied from period to period. This is to ensure that financial statements are comparable over time.

Legal and Regulatory Considerations for Business Inventory Books

Maintaining accurate and compliant inventory records is crucial for businesses, as they serve as the basis for various financial and operational decisions. Legal and regulatory requirements govern the recording and maintenance of inventory books, and non-compliance can result in penalties and reputational damage.

Legal Requirements

- Internal Revenue Code (IRC):Requires businesses to maintain adequate inventory records for tax purposes, including the cost of goods sold, beginning and ending inventory, and inventory adjustments.

- Uniform Commercial Code (UCC):Provides rules for the creation, perfection, and enforcement of security interests in inventory.

- Generally Accepted Accounting Principles (GAAP):Establish standards for the recording and valuation of inventory, including the lower of cost or market rule.

Consequences of Non-Compliance

- Tax penalties:Incorrect inventory records can lead to underpayment or overpayment of taxes.

- Financial statement misstatement:Inaccurate inventory records can distort financial statements, misleading investors and creditors.

li> Legal liability:Non-compliance with legal and regulatory requirements can result in fines, lawsuits, or even criminal charges.

Best Practices for Maintaining Compliant Inventory Books, Business inventory book

- Establish clear policies and procedures:Develop written guidelines for inventory management, including record-keeping requirements.

- Use a reliable inventory management system:Implement software or manual systems that track inventory accurately and efficiently.

- Conduct regular physical counts:Verify the physical inventory against the records to ensure accuracy.

- Document inventory adjustments:Record all changes to inventory, including purchases, sales, returns, and spoilage.

- Retain inventory records:Keep inventory books and supporting documentation for the required period of time.

Closing Notes: Business Inventory Book

In conclusion, the business inventory book emerges as an indispensable tool for businesses seeking to streamline their inventory management processes. By harnessing the insights and techniques Artikeld in this guide, organizations can effectively control inventory levels, optimize valuation, and maintain compliance, paving the way for operational efficiency and financial success.

FAQ Summary

What is the purpose of a business inventory book?

A business inventory book serves as a central repository for recording and tracking inventory items, providing a comprehensive overview of stock levels, quantities, and values.

What are the key components of a business inventory book?

Essential components include item descriptions, quantities, unit prices, dates of transactions, and any additional relevant information.

What are the different types of business inventory books?

Perpetual inventory books provide real-time updates, while periodic inventory books require periodic physical counts.

How can a business inventory book help control inventory levels?

By tracking inventory movements and stock levels, businesses can identify trends, prevent stockouts, and avoid overstocking.

What is the importance of inventory valuation in a business inventory book?

Inventory valuation methods, such as FIFO and LIFO, impact financial reporting and tax calculations.